Carbon Credits: Chestnut Carbon Raises $160 Million

In a bold move to combat climate change, nature-based carbon removal startup Chestnut Carbon has successfully secured $160 million in Series B funding, a testament to the growing interest in carbon credits among tech giants and investors alike. As the demand for sustainable solutions intensifies, particularly in light of rising emissions from expanding data centers, Chestnut is poised to make a significant impact by revitalizing marginal and degraded farmland through reforestation. This innovative approach not only promises to enhance biodiversity but also aims to capture and store substantial amounts of carbon, aligning ecological restoration with market-driven strategies. With ambitious plans to scale operations and transform hundreds of thousands of acres back into thriving forests, Chestnut Carbon is at the forefront of a pivotal movement to mitigate the climate crisis.

| Category | Details |

|---|---|

| Company Name | Chestnut Carbon |

| Funding Amount | $160 million |

| Funding Round | Series B |

| Investors | Canada Pension Plan Investment Board, Cloverlay, DBL Partners, university endowments, family offices, funds of funds, other institutional investors |

| Founder | Kimmeridge (initial funding), Kyle Holland (Forest Carbon Works) |

| Primary Activity | Purchasing farmland, planting native trees, and harvesting carbon credits |

| Current Holdings | Over 35,000 acres of marginal and degraded farmland in the southeastern US |

| Target Carbon Credit Capacity | 100 million metric tons by 2030 |

| Recent Sale | 7 million carbon credits to Microsoft |

| Agreement Duration | 25 years |

| Land Rehabilitation | 60,000 acres in Arkansas, Louisiana, and Texas |

| Certification Standard | Gold Standard for 100 years |

| Global Carbon Emissions (2023) | 37.4 billion metric tons |

| Potential Forest Growth | 2.2 billion more acres of forest possible |

| Carbon Storage Potential | 205 billion metric tons of carbon when mature |

What is Carbon Credit and Why is it Important?

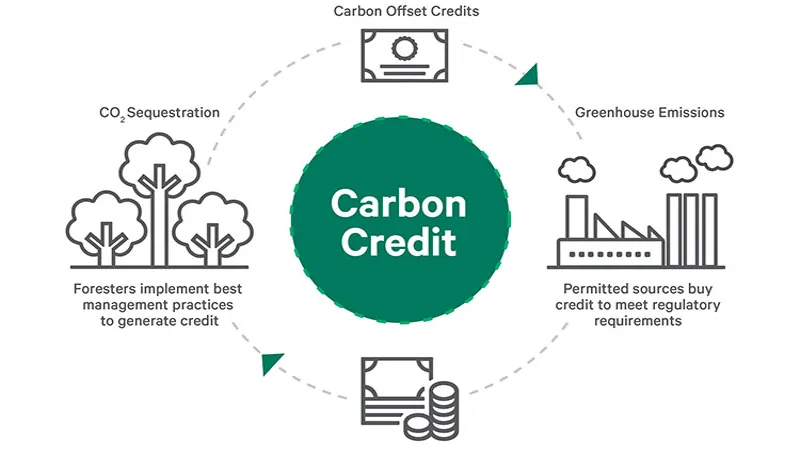

Carbon credits are special permits that allow companies to release a certain amount of carbon dioxide into the atmosphere. For every ton of carbon they emit, they can buy one credit, which helps offset their pollution. This is important because too much carbon in the air can lead to climate change, causing problems like extreme weather and rising sea levels. By purchasing carbon credits, companies can take responsibility for their emissions and contribute to a cleaner environment.

In recent years, carbon credits have gained popularity, especially among tech companies. As businesses grow, so do their emissions, particularly with the rise of cloud computing and artificial intelligence. By investing in carbon credits, they can balance out their impact on the planet. This creates a win-win situation: companies can continue to operate while supporting initiatives that work towards a healthier Earth.

Chestnut Carbon: A Champion for Nature

Chestnut Carbon is a startup focused on using nature to help reduce carbon emissions. They buy degraded farmland and plant trees to create forests, which absorb carbon dioxide from the atmosphere. This not only helps the environment but also generates carbon credits that can be sold to companies looking to offset their emissions. With $160 million in new funding, Chestnut aims to expand their projects and make a more significant impact on climate change.

The company has a bold goal of restoring hundreds of thousands of acres of land by 2030. This expansion will help them reach an ambitious target of 100 million metric tons of carbon credits. By investing in nature-based solutions like reforestation, Chestnut Carbon is tackling climate change head-on while providing a sustainable way for businesses to meet their environmental goals.

Investing in a Greener Future

The recent $160 million investment in Chestnut Carbon highlights the growing interest in sustainable practices. Investors from various backgrounds, including pension funds and family offices, see the potential for profit while also addressing climate issues. This trend shows that people are beginning to understand the importance of funding projects that benefit both the planet and the economy. By supporting companies like Chestnut, investors are playing a crucial role in creating a greener future.

Furthermore, by focusing on nature-based carbon removal, Chestnut is paving the way for innovative solutions to environmental problems. As more investors support these initiatives, it creates a ripple effect, encouraging other startups and companies to adopt sustainable practices. This shift in investment strategies is essential for transforming our approach to climate change and ensuring a healthier world for future generations.

How Carbon Credits Help Combat Climate Change

Carbon credits play a vital role in tackling climate change by providing a financial incentive for reducing greenhouse gas emissions. When companies invest in carbon credits, they help fund projects that absorb carbon dioxide, like Chestnut Carbon’s tree-planting initiatives. This creates a healthier environment and encourages more businesses to take action against climate change. By purchasing carbon credits, companies support a cleaner future and contribute to global efforts to reduce emissions.

Additionally, the carbon credit market is expanding, offering more opportunities for businesses to engage in sustainable practices. As demand for high-quality carbon credits grows, companies are pushed to improve their environmental strategies. This shift not only helps mitigate climate change but also promotes innovation and job creation in the green economy, illustrating that caring for the planet can also benefit people.

Transforming Degraded Land into Forests

Transforming degraded land into thriving forests is a critical part of Chestnut Carbon’s mission. By purchasing marginal farmland, they breathe new life into areas that may have suffered from neglect or poor management. These revitalized spaces not only contribute to carbon capture but also enhance biodiversity, providing habitats for various species. Rehabilitating land in this way is a powerful method to address environmental issues while promoting a balanced ecosystem.

Moreover, this transformation process can create numerous benefits for local communities. When new forests are established, they can provide resources like timber, recreational spaces, and improved air quality. Chestnut Carbon’s efforts to restore land not only help fight climate change but also support sustainable development and community wellbeing, demonstrating how environmental initiatives can yield multiple advantages.

The Role of Technology in Carbon Credit Management

Technology plays a crucial role in managing carbon credits effectively. Companies like Chestnut Carbon utilize advanced data analysis tools to track carbon absorption and monitor the health of their forests. These technologies ensure that carbon credits are accurately measured and verified, which is essential for maintaining trust in the carbon credit market. As tech continues to evolve, it will enhance the efficiency and transparency of carbon credit transactions.

Additionally, technology can help expand the reach of carbon credit projects. By using satellite imagery and drones, companies can assess large areas of land quickly and accurately. This innovative approach allows startups like Chestnut to identify potential sites for reforestation and track their progress over time. Embracing technology not only streamlines operations but also maximizes the positive impact of carbon credit initiatives.

Frequently Asked Questions

What does Chestnut Carbon do?

Chestnut Carbon is a startup that buys degraded farmland, plants native trees, and sells carbon credits to help offset carbon emissions from companies.

How much funding did Chestnut Carbon raise?

Chestnut Carbon raised $160 million in Series B financing to expand its operations and carbon credit capacity.

What are carbon credits and why are they important?

Carbon credits are permits allowing companies to emit a certain amount of carbon. They are important for reducing greenhouse gases and combating climate change.

Who invested in Chestnut Carbon’s recent funding round?

Investors included the Canada Pension Plan Investment Board, Cloverlay, DBL Partners, and various institutional investors and endowments.

What is Chestnut Carbon’s goal for carbon credits by 2030?

Chestnut aims to expand its carbon credit capacity to 100 million metric tons by 2030 through reforestation efforts.

How does Chestnut Carbon ensure the quality of its carbon credits?

Chestnut Carbon certifies its carbon credits using the Gold Standard, ensuring they are reliable and effective in carbon reduction.

What is the potential impact of Chestnut Carbon’s projects on climate change?

Chestnut Carbon’s afforestation projects could significantly mitigate climate change by storing carbon and restoring ecosystems.

Summary

Chestnut Carbon, a startup focused on nature-based carbon removal, has raised $160 million in Series B funding to expand its operations. The company buys degraded farmland to plant native trees and produces carbon credits, which are valuable for companies like Microsoft aiming to offset emissions. With this new funding, Chestnut aims to increase its landholdings and reach a target of 100 million metric tons of carbon credits by 2030. Their efforts contribute to combating climate change, as studies show more forests could significantly reduce atmospheric carbon levels.