Agentic AI: Unique Raises $30M for Financial Automation

In the rapidly evolving landscape of financial technology, Swiss startup Unique is making waves with its innovative approach to artificial intelligence. Established in 2021, this four-year-old company has recently secured $30 million in a Series A funding round, spearheaded by London-based venture capital firm DN Capital and Germany’s CommerzVentures. Unique is not just another player in the AI space; it is at the forefront of the agentic AI movement, which empowers systems to autonomously perform complex tasks across various sectors, including banking and insurance. With ambitious plans to streamline workflows and enhance decision-making in finance, Unique is poised for significant growth and expansion, particularly in the United States.

| Category | Details |

|---|---|

| Company Name | Unique |

| Founded | 2021 |

| Location | Zurich, Switzerland |

| Funding Raised | $30 million in Series A |

| Lead Investors | DN Capital, CommerzVentures |

| Total Funding to Date | $53 million |

| Key People | Manuel Grenacher (CEO), Michelle Heppler (CCO), Andreas Hauri (CTO) |

| Technology Focus | Agentic AI for finance |

| Main Applications | Investment research, due diligence, compliance |

| Notable Clients | Pictet, UBP, Graubündner Kantonalbank |

| Future Plans | Expand into international markets, especially the USA |

What is Unique?

Unique is a young and exciting startup from Switzerland that began its journey in 2021. Founded by a team of talented individuals including CEO Manuel Grenacher, CCO Michelle Heppler, and CTO Andreas Hauri, Unique has quickly made a name for itself in the world of finance technology. The company recently raised $30 million in a funding round, which will help it grow and develop new AI tools for financial services.

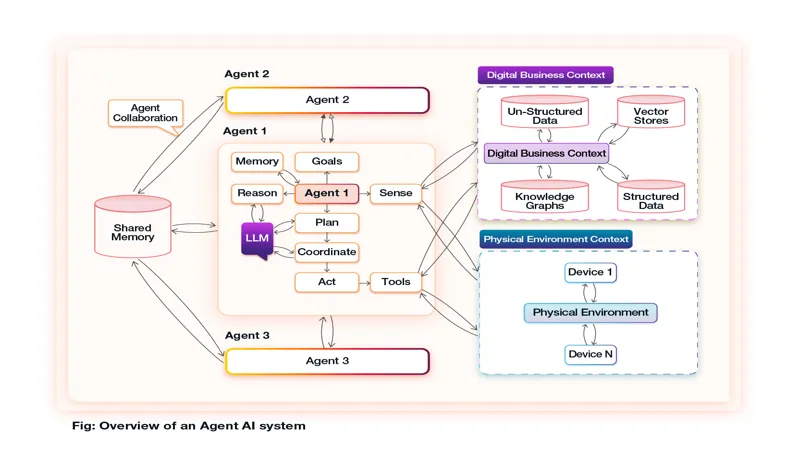

The startup focuses on ‘agentic AI’, which is a special kind of artificial intelligence that can make decisions and perform tasks on its own. This is different from regular chatbots, which can only respond to questions. With its innovative technology, Unique aims to help banks, insurance companies, and other financial institutions work smarter and more efficiently.

The Power of Agentic AI

Agentic AI is changing the way financial services operate. Unlike basic chatbots, which simply provide answers, agentic AI can analyze data, make decisions, and automate complex processes. This means that finance teams can save time and effort, allowing them to focus on more important tasks. For example, Unique’s AI agents can help with investment research by pulling information from various sources and answering questions in natural language.

By using agentic AI, financial institutions can improve their workflows and make better decisions. Unique’s tools not only help with research but also streamline compliance and due diligence processes. This allows banks and other firms to operate more efficiently while reducing the chances of errors, making it a valuable asset in the financial industry.

Unique’s Innovative Tools

Unique offers a variety of customizable AI tools designed to meet the specific needs of financial organizations. One of their standout products is an AI agent that assists with investment research. This tool can analyze both internal and external data, providing insights that are easy to understand and use. It allows finance teams to ask questions in their everyday language and receive instant, relevant answers.

Another important tool from Unique is the due diligence agent. This innovative tool can review meeting transcripts and compare them with previous evaluations. It then suggests relevant questions for bank personnel, ensuring that important details are never overlooked. These tools help finance teams work together more effectively, making their jobs easier and more productive.

Partnerships with Financial Institutions

Unique has formed strategic partnerships with several well-known financial institutions, which is a big win for the startup. One of their key partners is Pictet, a private bank in Switzerland. This partnership not only provides Unique with valuable insights into the banking world but also makes Pictet a strategic investor in the company. This collaboration helps Unique refine its tools and reach more clients in the financial sector.

Other notable clients include UBP and Graubündner Kantonalbank, showcasing the trust and interest Unique has garnered in the finance industry. By working closely with these institutions, Unique can better understand their needs and create AI solutions that truly make a difference in their operations.

Expansion Plans for Unique

With the recent funding of $30 million, Unique is ready to take its innovative solutions beyond Switzerland. The company has plans to expand into international markets, especially the United States. This expansion will allow Unique to reach a wider audience and help more financial institutions improve their workflows with agentic AI.

Unique’s growth strategy involves not just expanding its client base but also continuously developing new features and tools for its AI agents. By entering the U.S. market, Unique is looking to establish itself as a leader in the financial technology space, making a significant impact on how finance teams operate around the world.

The Future of AI in Finance

The rise of agentic AI is just the beginning of a new era in finance. As more companies recognize the value of AI tools, we can expect to see even more innovative solutions emerging. Unique is at the forefront of this movement, paving the way for smarter, more efficient financial services.

In the coming years, as financial institutions adopt these advanced AI technologies, we may see significant changes in how they operate. From automating routine tasks to making quick, data-driven decisions, the future of finance looks bright with the integration of AI. Unique’s commitment to developing these technologies will play a crucial role in shaping this future.

Frequently Asked Questions

What is Unique and what do they do?

Unique is a Swiss startup that uses advanced AI to automate tasks in finance, like banking and insurance, helping teams work more efficiently.

How much funding has Unique raised?

Unique has raised a total of $53 million, including $30 million in a recent Series A funding round.

What is agentic AI?

Agentic AI is a type of artificial intelligence that can make decisions and perform tasks on its own, unlike simple chatbots.

Who are the founders of Unique?

Unique was founded in 2021 by Manuel Grenacher (CEO), Michelle Heppler (CCO), and Andreas Hauri (CTO) in Zurich.

What sectors does Unique’s AI target?

Unique’s AI tools are designed for various sectors, including banking, insurance, private equity, research, and compliance.

Who are Unique’s clients?

Unique serves notable clients like Pictet, UBP, and Graubündner Kantonalbank, enhancing their financial services with AI.

What are Unique’s future plans?

Unique aims to expand internationally, especially into the U.S. market, using their recent funding to accelerate growth.

Summary

Unique is a Swiss startup founded in 2021 that has recently raised $30 million to expand its innovative AI technology in finance. Led by CEO Manuel Grenacher, Unique focuses on “agentic AI,” which can perform complex tasks and make decisions independently, unlike regular chatbots. Their AI tools help automate financial workflows like investment research and compliance. Unique aims to become a key partner for finance teams, having already collaborated with Swiss private bank Pictet and serving clients like UBP. With this new funding, they plan to grow internationally, especially in the United States.