Carbon Capture Technology: A Win-Win for Oil Companies

In the evolving landscape of energy and climate technology, the recent acquisition of Carbon Engineering by Occidental Petroleum highlights a pivotal shift in strategy for fossil fuel companies. Initially hailed as a progressive step towards mitigating climate impact, this merger has taken on new significance as Occidental’s leadership reveals a dual purpose for the carbon capture technology: not just to reduce emissions, but to enhance oil production. This controversial approach raises critical questions about the intersection of climate goals and fossil fuel extraction, as industry giants seek to capitalize on carbon capture’s potential while navigating the complexities of environmental policy and market incentives.

| Category | Details |

|---|---|

| Acquisition | Occidental acquired Carbon Engineering, a carbon capture startup. |

| Deal Outcome | Celebrated as a win-win: tech company achieved exit, fossil fuel company entered a new sector. |

| Market Value Projection | The carbon capture sector could be valued at up to $150 billion by 2050. |

| Technology Purpose | Occidental aims to use the technology to extract more oil, not just negate climate impact. |

| CEO Statement | Vicki Hollub emphasized CO2 injection is essential for boosting oil production. |

| CO2 Injection | Similar to fracking, it enhances oil recovery but is costly at $600 to $1,000 per metric ton. |

| Inflation Reduction Act Incentives | Offers up to $130 per metric ton for captured CO2 used in enhanced oil recovery. |

| Profit Expectations | Occidental hopes to profit from carbon credit sales by the end of the decade. |

| Historical Context | Fossil fuel companies began CO2 injections in the 1970s and started using pipelines in the 1980s. |

| Petra Nova Facility | First carbon capture facility linked to a coal plant, capturing a third of CO2 but was shut down in 2020. |

| Future of Direct Air Capture | Direct air capture could provide enough CO2 to make oil drilling carbon negative. |

| Regulatory Uncertainty | Uncertain if federal incentives for direct air capture will continue in the next four years. |

The Carbon Capture Acquisition: A Game-Changer for Energy

Two years ago, a big event happened in the energy world when Occidental, an oil and gas company, bought a startup called Carbon Engineering. This was exciting because it showed how a company focused on climate tech could succeed while a fossil fuel company looked for new ways to use technology. The deal hinted that carbon capture could be a huge opportunity worth up to $150 billion by 2050, changing how we think about energy production and environmental care.

Occidental’s interest in Carbon Engineering was more than just for the environment. Initially, they wanted to use the carbon capture technology to help reduce the damage they caused to the climate. However, recently, CEO Vicki Hollub revealed a new plan: they want to use the captured CO2 to help get more oil from the ground. This strategy shows how companies are balancing the need for energy with the responsibility of protecting our planet.

Understanding Enhanced Oil Recovery with CO2

Enhanced oil recovery (EOR) is a technique that has been used to get more oil out of wells. Occidental’s CEO compared it to fracking, another method that has boosted oil production in the U.S. But what really matters is how this technology uses CO2. By injecting carbon dioxide into oil wells, companies like Occidental hope to increase the amount of oil they can extract. This method could change the way we think about oil production and its impact on climate change.

The process of injecting CO2 into wells isn’t new; it has been used since the 1970s. However, the costs of capturing and using CO2 remain high, making it hard for companies to make a profit. With the Inflation Reduction Act, there are incentives to encourage companies to use captured CO2. Despite the challenges, the potential for enhanced oil recovery to boost production is significant, leading to discussions about how to make it more appealing for the future.

The Role of Government Incentives in Carbon Capture

Government incentives play a big role in making carbon capture technology work. The Inflation Reduction Act offers tax credits for companies that use captured CO2. For instance, companies can receive up to $130 per metric ton of CO2 if they store it underground. This financial support is crucial for companies like Occidental to take risks and invest in new technologies, even though it might not be enough to make the practice attractive on its own.

However, there’s uncertainty about whether these incentives will last. The Trump administration has been trying to reduce support for climate change initiatives. Still, with backing from major oil companies, there’s a chance these tax credits could continue. Protecting these incentives could help carbon capture technologies grow, making it easier for oil companies to invest in more sustainable practices while still meeting energy demands.

The Past and Future of Carbon Capture Technology

Carbon capture technology has a rich history intertwined with fossil fuels. Companies have been injecting CO2 into wells since the 1970s to help extract oil. In the early 1980s, pipelines were built to transport CO2, but low oil prices made this technique less popular. A decade ago, NRG Energy made strides by creating the Petra Nova facility, the first carbon capture plant linked to a coal-fired power plant, showcasing the potential of this technology.

Petra Nova was designed to capture a significant amount of CO2, but it didn’t meet all expectations. Although production increased, it was not enough to keep the facility running during the pandemic. Today, despite challenges, there’s renewed interest in carbon capture, especially with rising oil prices. Finding ways to make carbon capture more effective and affordable is essential for its future, and companies are exploring innovative solutions to achieve this goal.

The Future of Oil Production: A Balancing Act

As the world grapples with climate change, the future of oil production is a delicate balance. Companies like Occidental are exploring how to increase oil production while also minimizing their carbon footprint. By investing in carbon capture technology, they hope to create a system where drilling for oil could actually help the environment. This idea of making oil production carbon negative is intriguing but requires more research and development to become a reality.

Finding this balance is crucial as it can influence global energy policies. With ongoing discussions about climate change and energy needs, oil companies must navigate their strategies carefully. By supporting technologies like carbon capture, they can play a role in a cleaner energy future while still meeting the world’s demand for oil. The path forward will require cooperation between governments, companies, and communities to ensure a sustainable energy landscape.

Challenges Ahead: The Viability of Carbon Capture

Despite the promising potential of carbon capture, several challenges lie ahead. The high costs of capturing CO2 at $600 to $1,000 per metric ton make widespread adoption difficult. While incentives from the government can help, they may not be enough to turn a profit in the short term. Companies like Occidental are optimistic about the future, but they must find ways to address these financial hurdles to make carbon capture a viable option for the long term.

Additionally, the availability of CO2 is another challenge. For enhanced oil recovery to be successful, a sufficient supply of captured CO2 is necessary. While direct air capture could provide this, it remains to be seen whether the technology will scale effectively. As companies work on overcoming these obstacles, the future of carbon capture will depend on innovation, investment, and a supportive policy environment.

Frequently Asked Questions

What is the significance of Occidental acquiring Carbon Engineering?

Occidental’s acquisition of Carbon Engineering helps them enter the carbon capture market, potentially valued at $150 billion by 2050, while supporting climate technology development.

How does carbon capture technology work?

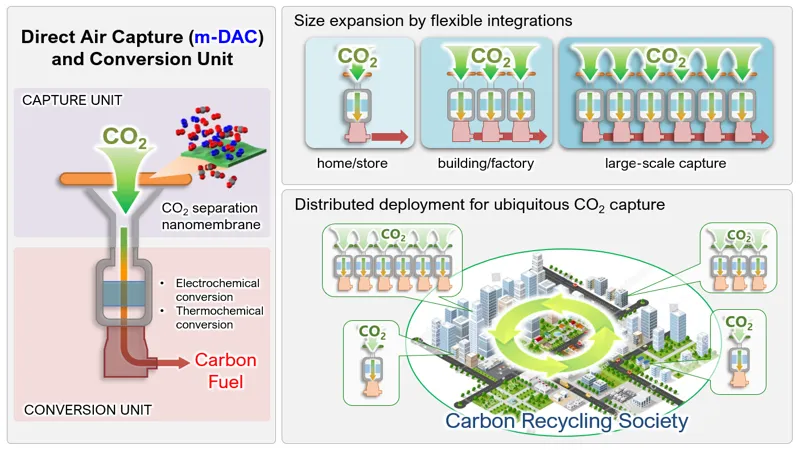

Carbon capture technology, like direct air capture, removes CO2 from the atmosphere and can be used to enhance oil recovery by injecting CO2 into oil wells.

What are the costs associated with direct air capture?

Direct air capture is expensive, costing between $600 and $1,000 per metric ton of CO2 captured, making it challenging for companies to profit solely from this technology.

How does the Inflation Reduction Act support carbon capture?

The Inflation Reduction Act offers tax incentives of up to $130 per metric ton for using captured CO2 in oil recovery, encouraging companies to adopt carbon capture methods.

What challenges does carbon capture face in the oil industry?

Carbon capture in the oil industry faces challenges like high costs, insufficient CO2 availability, and fluctuating oil prices that impact profitability and investment.

Can carbon capture make oil production carbon negative?

Yes, if CO2 from the air is captured effectively, it may allow oil drilling to sequester more carbon than it emits, although this idea requires further research.

What is the future of federal incentives for carbon capture?

The future of federal incentives for carbon capture remains uncertain, but they may have a better chance of surviving due to support from major oil companies.

Summary

Occidental, an oil and gas company, acquired Carbon Engineering, a carbon capture startup, two years ago, aiming to invest in climate technology. Their initial goal was to use this tech to lessen their environmental impact, but recent statements from CEO Vicki Hollub revealed a shift in focus. She indicated that they plan to use captured CO2 to enhance oil production, similar to fracking. Despite high costs for carbon capture, incentives from the Inflation Reduction Act could help Occidental profit by 2030, although the future of these incentives remains uncertain amidst changing government policies.