Buy Now Pay Later: Tabby’s Growth in Fintech Sector

As the fintech landscape evolves, understanding regional consumer preferences for credit options has never been more crucial. In developed markets, the popularity of credit cards has paved the way for innovative solutions like buy now, pay later (BNPL) services, which offer consumers flexibility in their purchasing decisions. However, the scenario shifts dramatically in emerging markets such as the Middle East, where limited credit card adoption coexists with high purchasing power, presenting unique opportunities for fintech companies. Among these, Tabby has emerged as a trailblazer, transforming the BNPL model into a household name across the region, driven by significant funding and rapid growth in its user base. This introduction sets the stage for exploring Tabby’s journey, its innovative offerings, and the competitive landscape it navigates in a dynamic financial ecosystem.

| Category | Details |

|---|---|

| Consumer Demand for Credit | Varies across regions; developed markets favor credit cards while emerging markets like the Middle East show high interest in BNPL. |

| Buy Now, Pay Later (BNPL) | Consumers in developed markets favor it due to flexible payment options; in the Middle East, low credit card usage makes BNPL appealing. |

| Tabby’s Funding | Raised $160 million in Series E, valued at $3.3 billion; previously raised $200 million in Series D at $1.5 billion. |

| Investors | Blue Pool Capital, Hassana Investment Company, STV, Wellington Management. |

| User Growth | Grew to 15 million customers across Saudi Arabia, UAE, and Kuwait, marking a 50% increase since October 2023. |

| Product Expansion | Tabby expanded from online transactions to in-store payments, retail, and financial services. |

| Tabby Card and Tabby Plus | Tabby Card allows flexible spending; Tabby Plus is a subscription rewards program. |

| Market Strategy | Acquired Tweeq to broaden financial services; targeting remittance market with focus on UAE-India corridor. |

| Competition | Competes with Tamara in BNPL and global players like Revolut in remittance. |

| Future Plans | Plans for an IPO on the Saudi Exchange; anticipates market conditions will influence timing. |

| Market Trends | Growing investor interest in tech IPOs in MENA; recent IPOs indicate appetite for high-growth startups. |

Understanding Consumer Demand for Credit

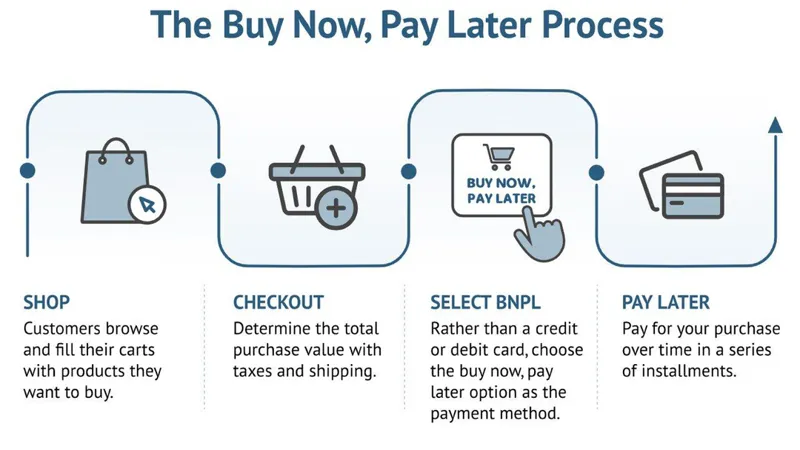

Consumer demand for credit options changes from one place to another. In developed countries where credit cards are common, people usually enjoy using buy now, pay later (BNPL) services. This is because BNPL allows them to pay for things in smaller amounts over time, making it easier to manage their money. For example, someone might use BNPL to buy a new video game without having to pay the full price all at once.

In contrast, in emerging markets like the Middle East, many people don’t use credit cards as much. However, they still want to buy things even if they don’t have the money right now. This is where BNPL becomes very useful. By letting consumers pay in installments, fintech companies can help them access products and services, which is especially important in areas with high purchasing power but low credit card usage.

The Rise of Tabby in the MENA Region

Tabby has quickly become a leader in the Middle East and North Africa (MENA) fintech scene. After recently raising $160 million, it is now valued at $3.3 billion, becoming the most valuable fintech in the region. This growth shows how much people are embracing BNPL services. Tabby’s success is a great example of how understanding consumer needs can lead to incredible business opportunities and a strong customer base.

Part of Tabby’s success comes from its ability to adapt. Initially focused on online shopping, Tabby has expanded into physical store payments and other financial services. With the launch of the Tabby Card and Tabby Plus, customers can enjoy more flexibility in their spending. This means they can now use Tabby for everything from groceries to ride-sharing apps, making it a popular choice among consumers.

Innovative Financial Services Offered by Tabby

Tabby is not just about BNPL anymore; it offers a range of financial services that help customers manage their money more effectively. Products like the Tabby Card and Tabby Shop allow users to spend wisely and access better deals through longer payment plans. With over 40,000 brands and merchants partnered with Tabby, customers have many choices, making it easier to shop and save at the same time.

Additionally, Tabby acquired a digital wallet provider called Tweeq, expanding its services even further. This move aligns with Saudi Arabia’s aim to go cashless, and it helps Tabby to offer more tools for budgeting and payments. By focusing on innovation and customer needs, Tabby ensures that it stays ahead in the competitive fintech landscape of the Middle East.

Targeting the Remittance Market

Tabby has exciting plans to enter the remittance market, which is a big opportunity for its business. With many expatriates in Saudi Arabia and the UAE sending money back home, Tabby can provide services that cater to this need. The company is particularly interested in the UAE-India remittance corridor, one of the busiest in the world.

Unlike traditional remittance companies, Tabby is looking to offer flexible options. For instance, it might allow users to split their remittances over time instead of sending all the money at once. This flexibility is something many customers will appreciate, especially those who want to manage their finances better while still helping family and friends abroad.

Competition in the Fintech Space

As Tabby grows, it faces competition from other fintech companies like Tamara and global players such as Revolut. These competitors are also looking to enter the lucrative markets of the Middle East. However, Tabby has built a strong reputation and a loyal customer base, which will help it to stand out in this crowded space.

Tabby’s local market expertise gives it an advantage over newcomers. By understanding the needs and preferences of its customers, Tabby can provide services that truly resonate with them. This strong connection with users, along with its vast network of merchants, positions Tabby well to continue its growth and success in the fintech sector.

Plans for an Initial Public Offering (IPO)

Tabby is also preparing for a big milestone: going public with an Initial Public Offering (IPO). This means that the company will offer its shares to the public for the first time, allowing anyone to invest in it. The recent $160 million funding round might be the last private investment before this IPO, showing that investors believe in Tabby’s potential.

Going public could help Tabby raise even more money to expand its operations and develop new products. Investors are excited about tech IPOs in the MENA region, and Tabby aims to be a leader in this movement. With its strong financial performance and strategic planning, Tabby is on the path to becoming one of the next big tech companies in the region.

Frequently Asked Questions

What is Tabby and what services does it offer?

Tabby is a fintech company in the Middle East that offers buy now, pay later options, a flexible spending card, and a rewards program, helping users manage their payments for various purchases.

How has Tabby’s valuation changed recently?

Tabby’s valuation has significantly increased, doubling from $1.5 billion to $3.3 billion in less than 18 months, following a successful Series E funding round.

What markets does Tabby operate in?

Tabby primarily operates in Saudi Arabia, the UAE, and Kuwait, supporting over 40,000 brands and catering to 15 million customers in these regions.

How does Tabby plan to expand its services?

Tabby is expanding into remittance services, focusing on expatriates and planning to introduce flexible payment options for sending money, especially targeting the UAE-India corridor.

Who are Tabby’s main competitors in the BNPL space?

Tabby competes with other fintech companies like Tamara in the buy now, pay later market, and faces competition from global players like Revolut in remittance services.

What are Tabby’s future plans regarding an IPO?

Tabby aims to go public on the Saudi Exchange soon, with this latest funding round potentially being its last private financing before the IPO.

Why is understanding regional credit demand important for fintech companies?

Understanding regional credit demand helps fintech companies like Tabby tailor their services effectively, ensuring they meet diverse consumer needs and thrive in varying market conditions.

Summary

Tabby, a leading fintech in the Middle East and North Africa (MENA), has rapidly grown in the buy now, pay later (BNPL) market, raising $160 million in its Series E funding round, boosting its valuation to $3.3 billion. Catering to diverse consumer credit needs, Tabby has expanded from online to in-store payments and launched innovative services like the Tabby Card and Tabby Plus, attracting 15 million customers. As it prepares for a potential IPO, Tabby is also targeting the lucrative remittance market, aiming to offer flexible money transfer options for expatriates in the region.